The long-awaited rule released by the Securities and Exchange Commission (SEC) on 27th June 2016, known as Section 1504, is a historic achievement and a significant step forward for transparency in the extractive sectors. The final rule was published in the Federal Register on 27th July, 2016 and becomes effective starting 26th September, 2016.

The rule requires oil, gas and mining companies listed on US stock exchanges to publicly report, by project, the payments made to US and foreign governments for access to natural resources in all countries of operation.

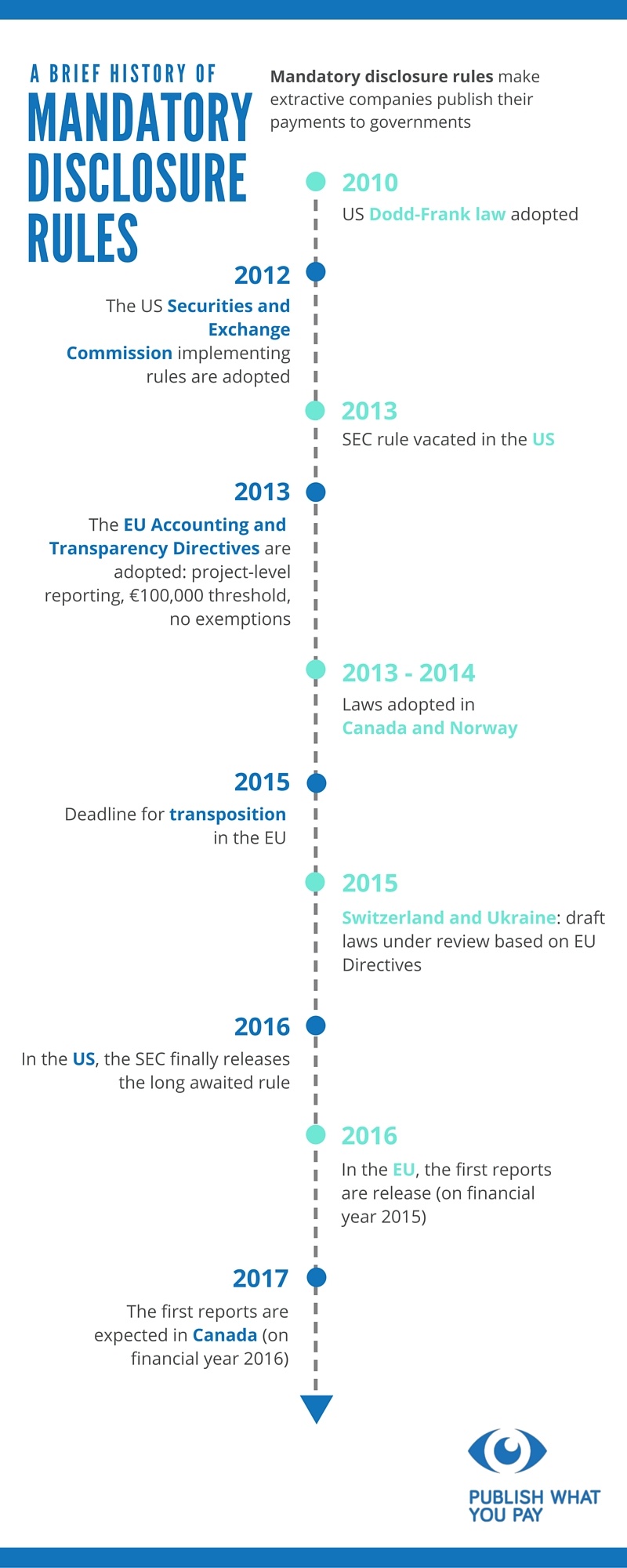

After an extremely long wait the Dodd-Frank Act was first adopted in 2010 – the final version of the rule has now been adopted – and has been a significant priority for Publish What You Pay (PWYP).

The first reports including payment data will cover the fiscal year to 30 September 2018, and are therefore expected to be released in late 2018/early 2019. Once released, PWYP’s Data Extractors will be able to analyse the reports and piece together a clearer picture of how US-listed companies and their projects play a role in affecting communities in the countries where natural resources are extracted.

The United States has the world’s largest extractives market, which means some of the largest oil companies, including Chevron and ExxonMobil and other state-owned companies, will have to disclose their payments. These payments from ‘superpower’ oil and extractive companies will hopefully encourage more laws and rules to come into place following the SEC initiative.

Having access to all this payment data makes it more difficult for companies to hide how they operate. This new transparent approach aims to provide communities with a greater understanding of how to follow money and hold their governments to account for how extractive related revenues are received and spent.

PWYP members in resource-rich countries want to use mandatory disclosures, such as the Dodd Frank rule, to reduce the opportunities for corruption or mismanagement. By implementing more rules like this, activists will have more chances to gather concrete evidence to support their claims and ensure no secret deals are passing under the radar.

The rule’s adoption will have a domino effect of project-level reporting in EITI participating countries. Article 5.2 of the EITI Standard states that “Reporting at project level is required, provided that it is consistent with the United States Securities and Exchange Commission rules and the forthcoming European Union requirements.” Though the EITI has yet to issue a timetable for enforcing this, it will further increase the amount of project-level data which we will see in the coming years.

See below for a brief history of mandatory disclosure rules: